Web Platform

Online Tax Filing Platform: Automated Tax Return Solution

December 6, 2024

Tax FilingNTN IntegrationPayment ProcessingGovernment Services

Secure Payment ProcessingNTN ValidationAdmin PortalData Security

Client and The Problem

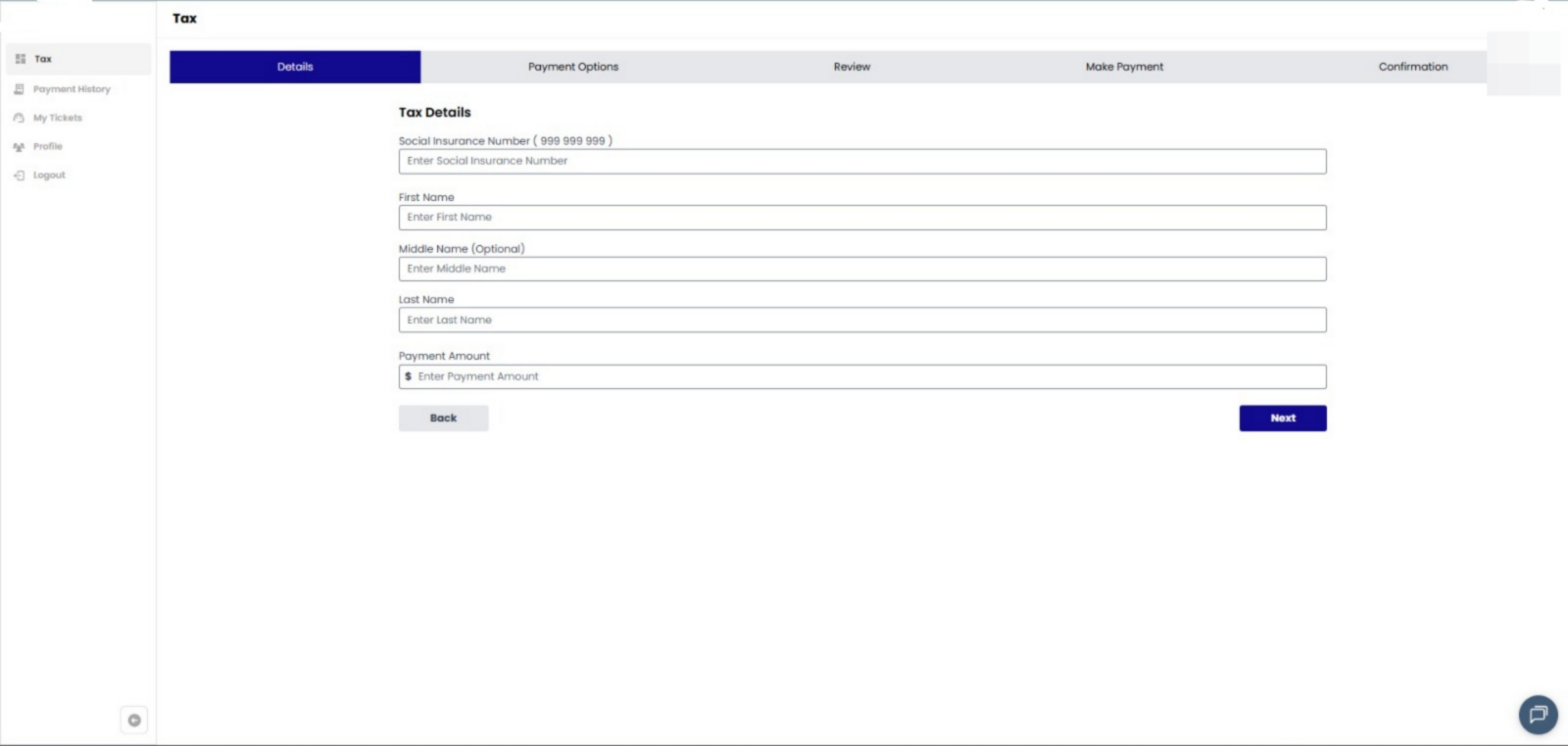

The client wanted a streamlined, centralized tax-filing and payment solution where users could submit tax information and pay directly online without dealing with manual paperwork, government portals, or complex procedures. The existing tax filing process was cumbersome, requiring physical visits to tax offices, manual form completion, and separate payment processes. Users needed a digital solution that would simplify tax submission while ensuring security and compliance with tax regulations.

Solution

-

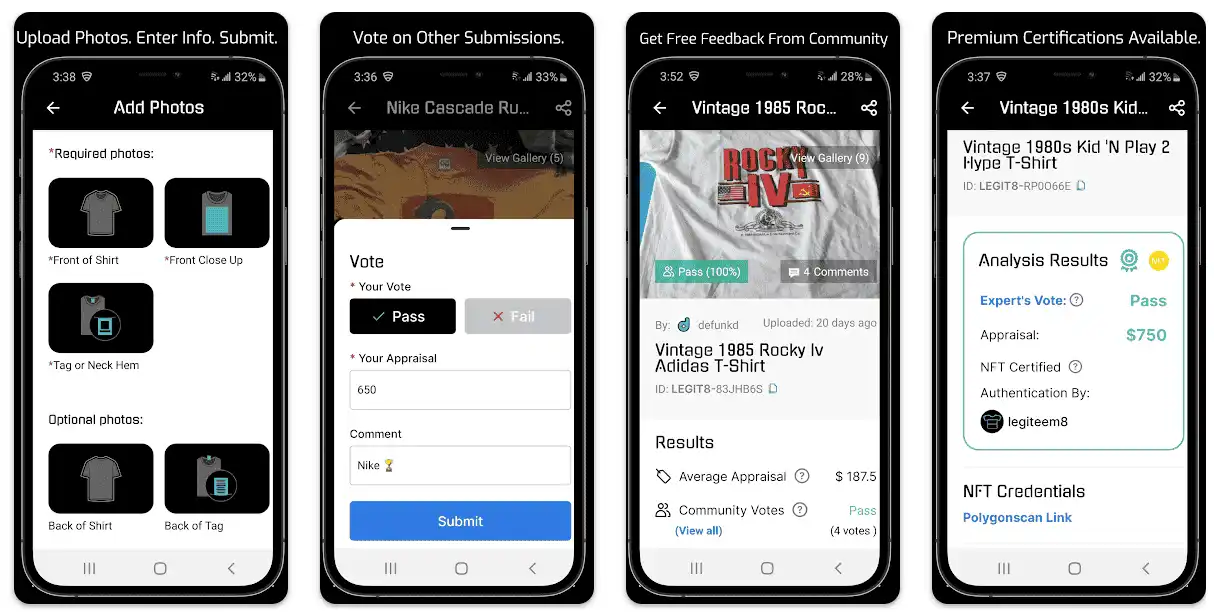

We developed a secure web application that allows users to enter their National Tax Number (NTN) details and file taxes online with integrated credit card payment processing. Online Tax Filing Platform includes a comprehensive user portal for managing tax records and payment history, and a centralized admin portal that enables tax authorities to oversee, verify, and process tax filings efficiently. The system features robust security measures for handling sensitive financial data, NTN validation systems, and a streamlined workflow that connects user submissions with administrative oversight.

Results

-

Online Tax Filing Platform successfully digitized the tax filing process, eliminating the need for manual paperwork and physical office visits. Users can now complete their tax submissions and payments entirely online using their NTN and preferred payment methods. The admin portal provides tax authorities with efficient tools to manage and process submissions, significantly reducing processing time and administrative overhead. The secure payment integration ensures safe handling of financial transactions, while the user portal gives taxpayers easy access to their filing history and payment records.

Timeframe

2 months

Have an AI Project you want done?

Book a time with our software team to discuss today.