Web Platform

Personal Finance Platform: Budgeting & Expense Tracking Tool

June 1, 2025

Personal FinanceFinTechAI RecommendationsFinancial Tracking

Technology

Client and The Problem

People with multiple credit cards and bank accounts struggle to keep track of balances, due dates, APRs, spending, rewards, and promotions across all their accounts. This leads to missed payments, high-interest costs, wasted rewards, and inefficient card usage. Users needed a centralized solution to aggregate all financial information, automate reminders and insights, and provide real-time guidance on optimal financial decisions to stay organized, avoid fees and interest, and maximize financial benefits.

Solution

-

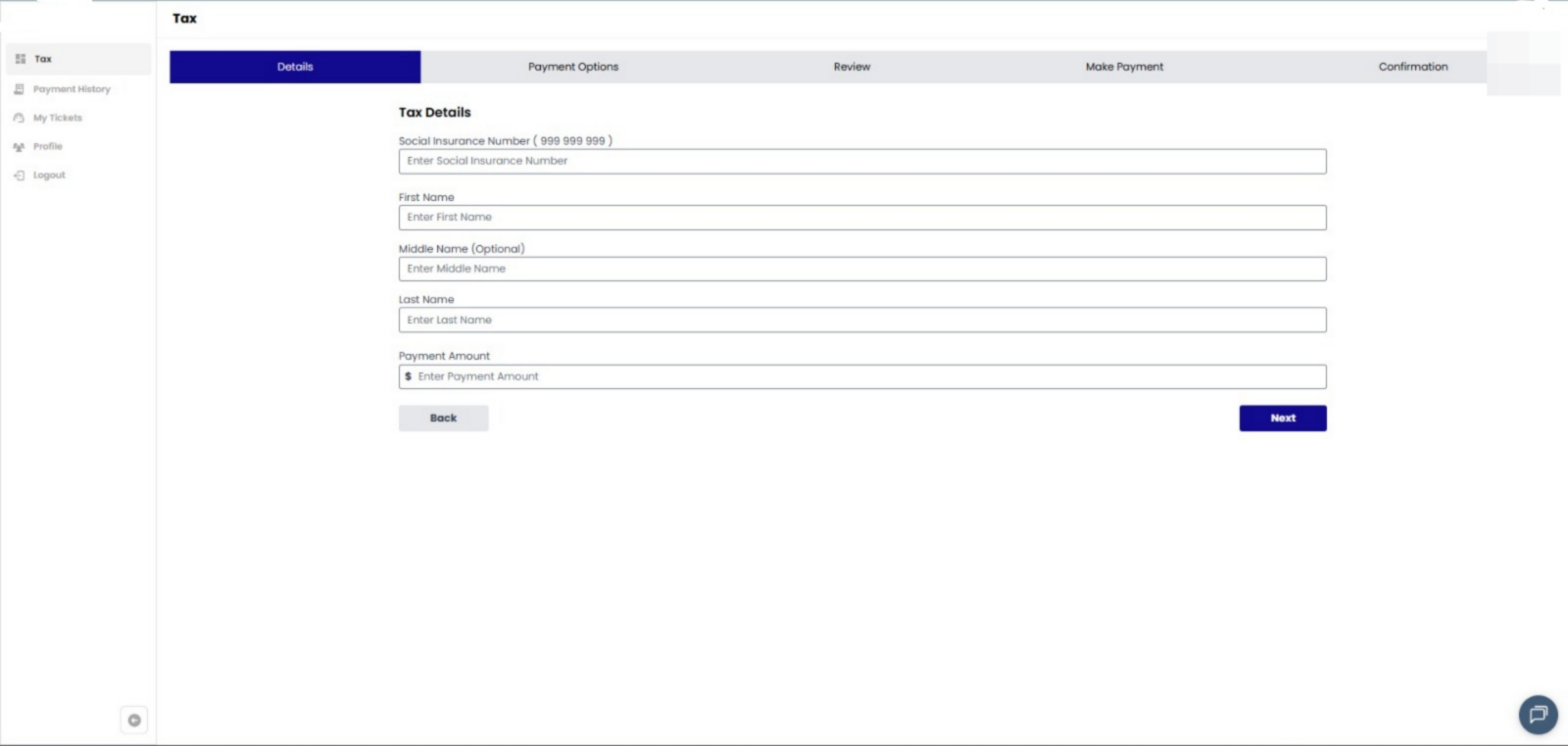

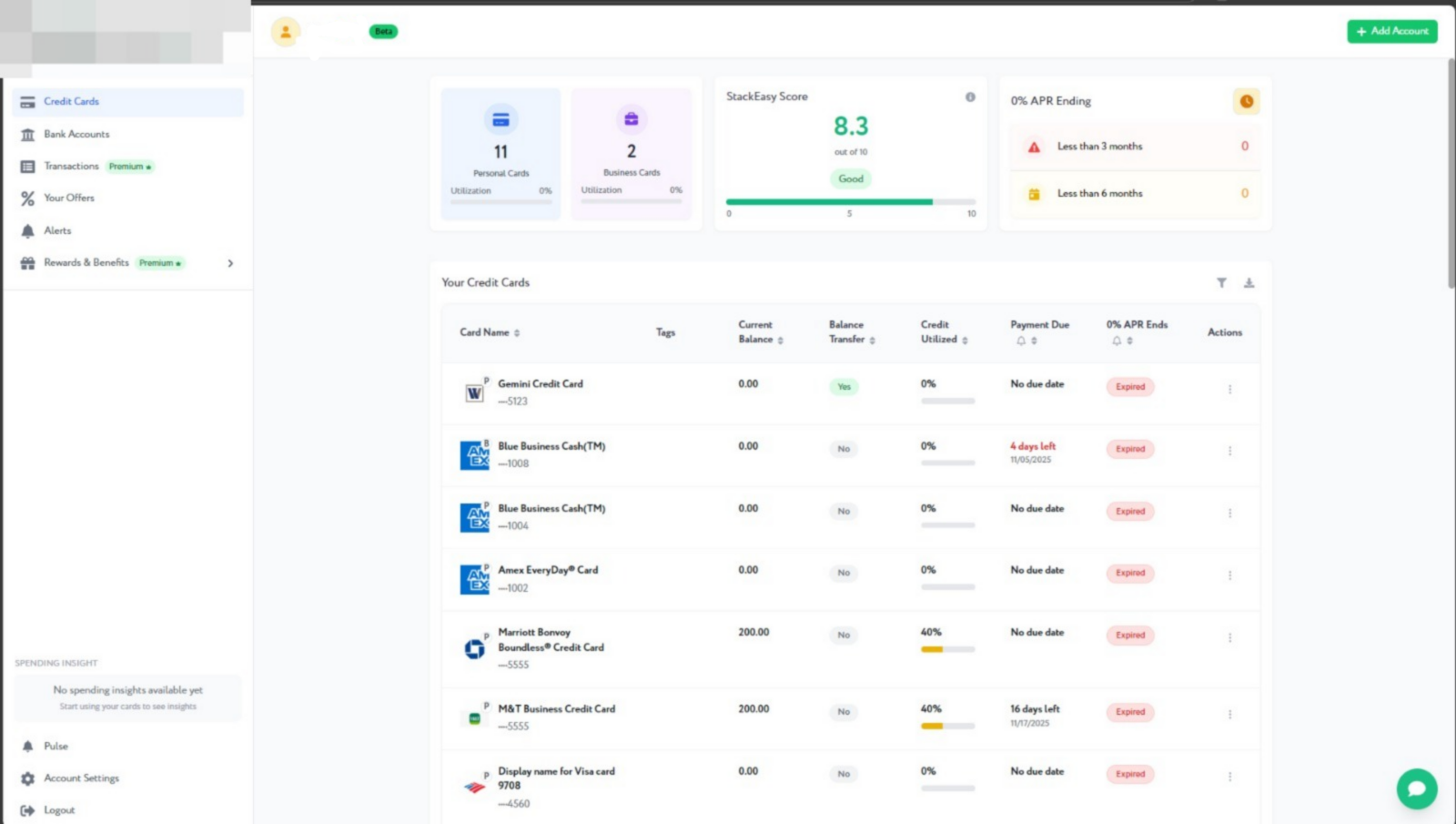

We developed Personal Finance Platform as a comprehensive two-tier personal finance platform. The Free tier provides real-time synchronization of all credit cards and bank accounts for balance tracking, instant visibility of current APRs, due dates, credit limits, and available credit, automated payment reminders to prevent missed due dates, identification of cards eligible for 0% interest and balance transfers, effortless spending monitoring across accounts from a unified dashboard, and an always-updated snapshot of financial health. The Premium tier adds powerful custom alerts for spending, utilization, and payments, AI-driven recommendations for card usage optimization and balance transfers, intelligent credit card insights including best card recommendations and hidden benefits, transaction-level insights with recurring subscription tracking and spend breakdowns, automatic rewards and cashback tracking with limited-time deal alerts, and advanced notifications with priority support and full data exports.

Results

-

Personal Finance Platform successfully created a centralized financial command center that eliminates the complexity of managing multiple financial accounts. Users now have complete visibility into their financial landscape with real-time balance tracking, automated payment reminders, and intelligent spending insights. The AI-powered recommendations help users optimize their card usage, maximize rewards, and avoid costly fees and interest charges. Personal Finance Platform comprehensive tracking of rewards, cashback, and promotional offers ensures users never miss valuable financial opportunities. Premium users benefit from advanced analytics, custom alerts, and personalized financial guidance that actively improves their financial health and decision-making.

Timeframe

4 months

Have an AI Project you want done?

Book a time with our software team to discuss today.