AI Insurance Platform

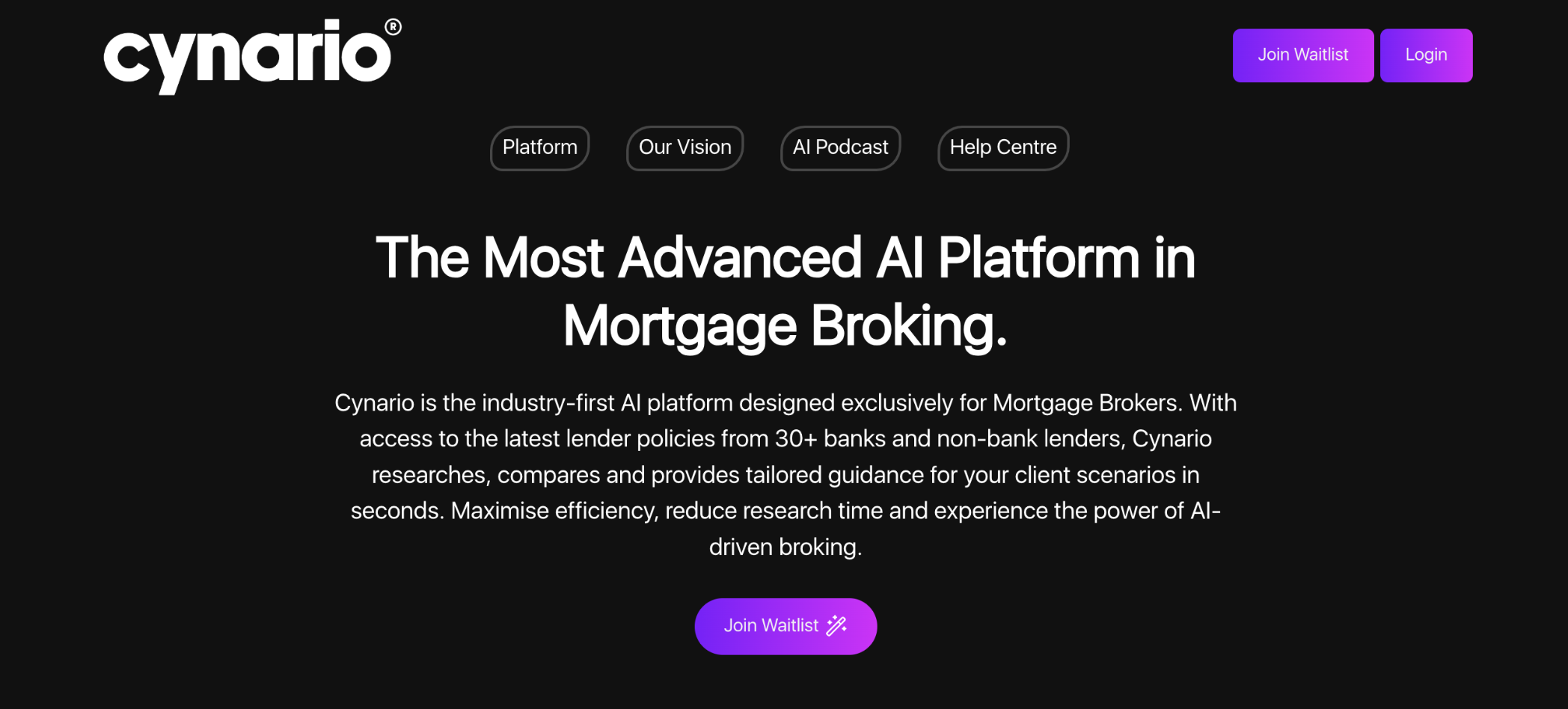

Cynario

June 1, 2024

AI Insurance PlatformLLMData ScrapingFinTech

PythonHTMLCSSJavascriptNodeJsLLMScraping

Client and The Problem

There are over 400 insurance brokers in Australia. They need to obtain many quotes to get the best real-time rates for their clients.

Solution

-

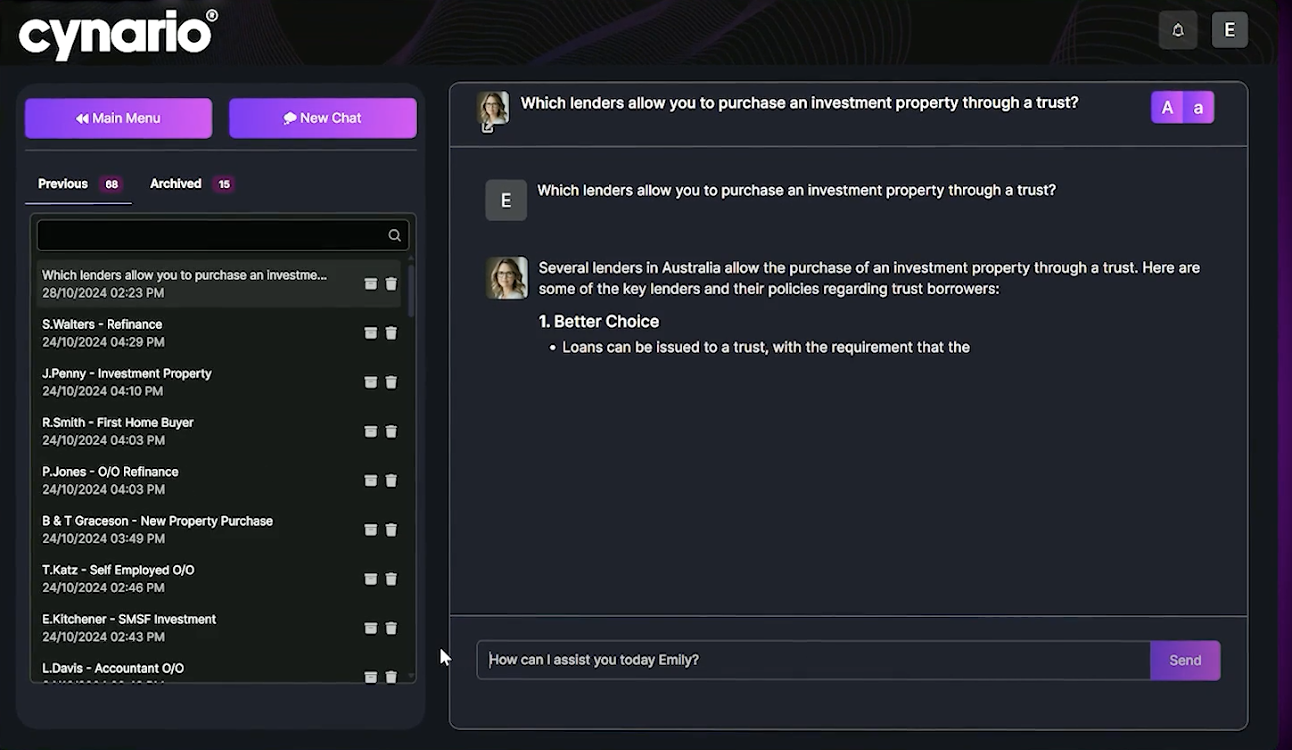

In the process of developing our AI insurance platform, we faced several challenges that required innovative solutions. First, we needed to identify all the insurance brokers operating in Australia, which involved extensive research and data collection. This task was crucial as it laid the foundation for our subsequent efforts. Next, we had to devise an efficient method for scraping data from various sources. Our goal was to minimize costs while maximizing the amount of relevant information we could gather. This required us to explore different scraping techniques and tools to ensure we could obtain the necessary data without incurring excessive expenses. At the outset of the project, we encountered limitations with the large language models (LLMs) available to us. They did not perform as well as we had hoped, prompting us to seek alternative approaches. We experimented with various hacks and layered techniques to enhance their capabilities, allowing us to achieve better results in processing and understanding the data. Additionally, we faced the challenge of reading and comparing different file types. This was essential for ensuring that we could accurately assess and integrate various versions of information. Our team developed strategies to handle these discrepancies, which ultimately improved the reliability of our data. Finally, we aimed to provide responses that were tailored to the language and expectations of insurance brokers. This required us to refine our communication strategies, ensuring that the information we delivered was not only accurate but also resonated with our target audience. By focusing on the specific needs and terminology of insurance professionals, we were able to enhance the overall user experience of our platform.

Results

-

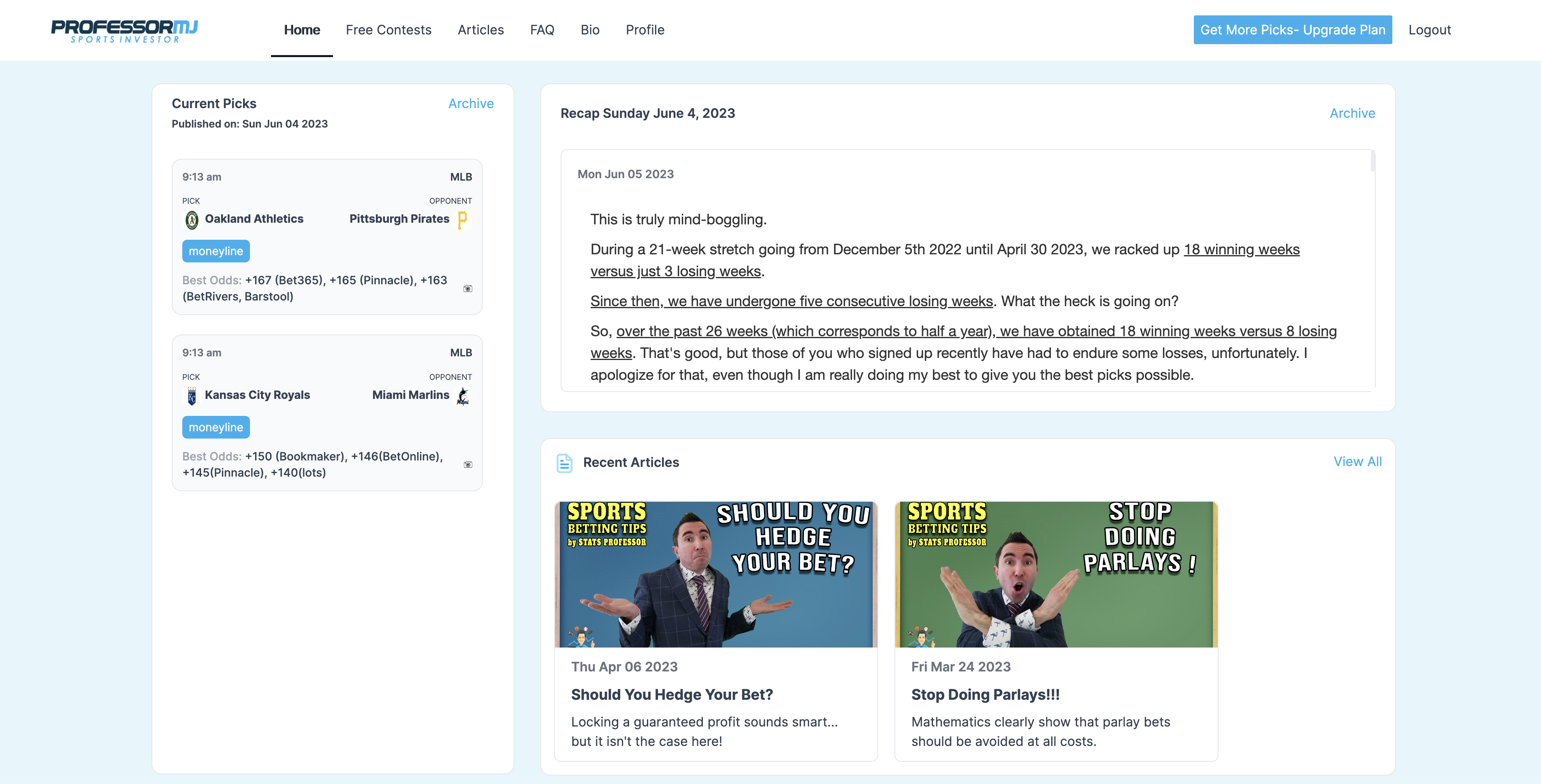

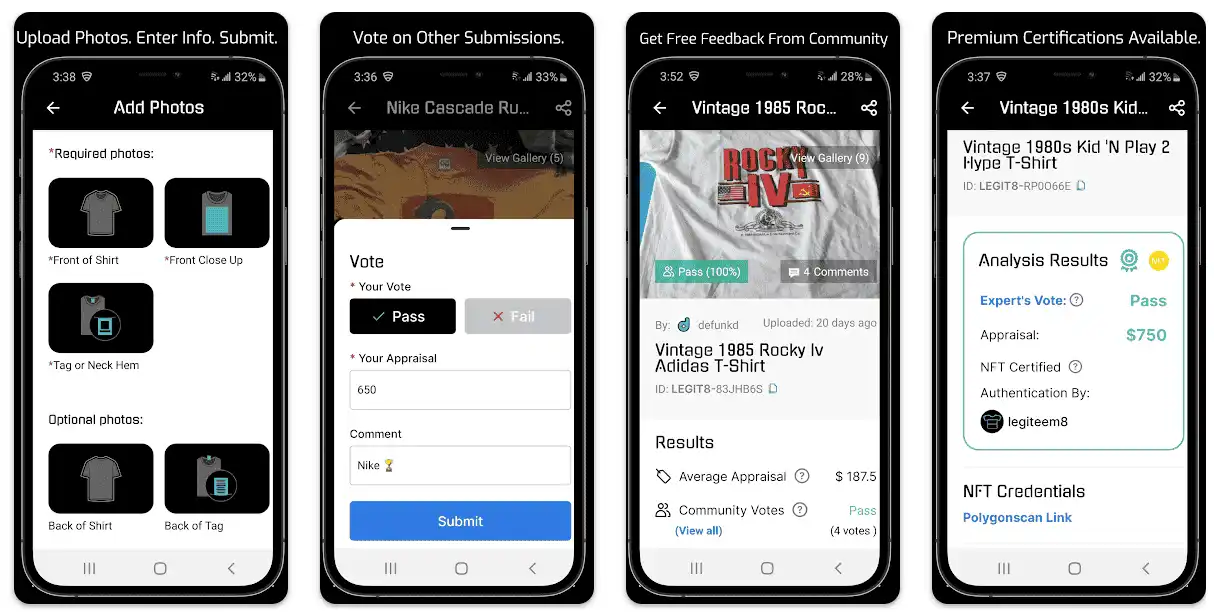

We developed a comprehensive platform that enables insurance brokers to quickly and accurately obtain policies using the latest advancements in large language model (LLM) technology. This platform ensures that brokers always have access to the most up-to-date version of policy information. Additionally, it features a chat function that allows brokers to communicate seamlessly from their mobile devices.

Timeframe

6 months

Have an AI Project you want done?

Book a time with our software team to discuss today.